NCB CAPFunds

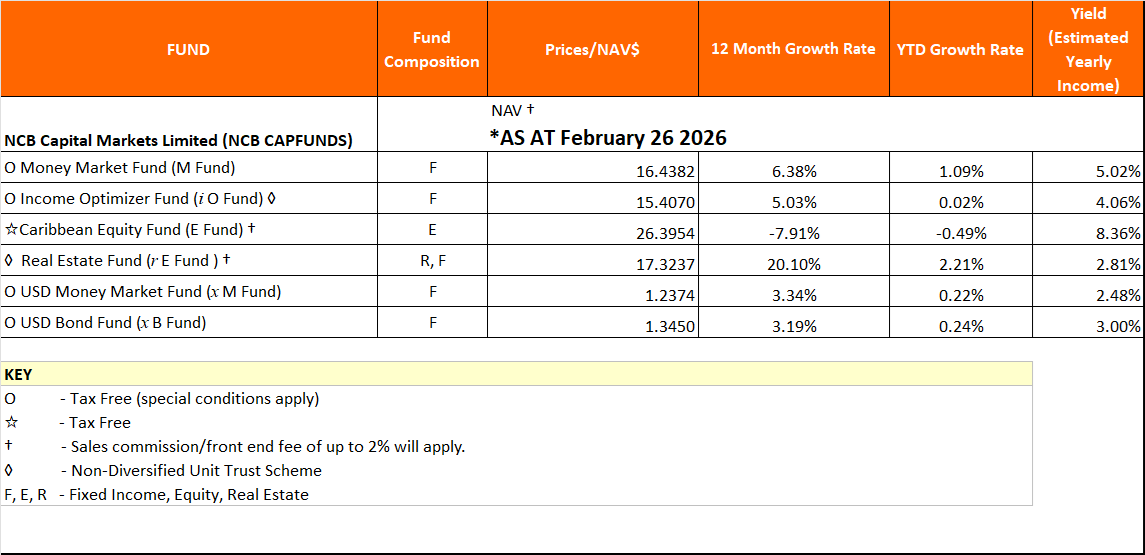

NCB CapFunds is designed to simplify your investment choice while delivering real value over the medium to longer term. Our unit trust product offers investors the option of six expertly managed funds to suit a variety of investment needs and investor risk appetites.

The cutoff-time for pricing of units is 12:00 pm daily.

Visit our FAQ Sheet and Offering Circular to find out more about our CAPFunds

NCB Capital Markets Non-Diversified Unit Trust Scheme

- Redemption Form

- Subscription Form

- Income Optimizer - Frequently Asked Questions

- Non-Diversified Unit Trust Scheme Offering Circular

NCB Capital Markets Diversified Unit Trust Scheme

- Subscription Form

- Redemption Form

- Diversified Unit Trust Scheme Offering Circular

- CAPFunds Financials

- Performance and Management Fees

NCB CAPFunds Fact Sheet

rE Fund | JMD Real Estate Fund

Invest in a portfolio which offers income distribution and medium to long term capital appreciation by providing investors with a broad range of income as well as growth producing real estate assets.

The rE Fund is a type of collective investment packaged under Non-diversified Unit Trust Scheme, which is managed by NCB Capital Markets Limited. The Fund will focus on a diversified portfolio of high quality commercial and residential real estate assets, with primary focus on local and regional assets. This is the second fund in NCB Capital Markets Non-Diversified Unit Trust Scheme.

iO Fund | JMD High Yield Asset and Loans Portfolio - Income Optimizer Fund

Invest in a portfolio with a moderate risk that allows access to a wider pool of high-yielding JMD assets managed to provide you with higher returns.

Our NCB CAP Income Optimizer Fund invests in medium-to-long term JMD denominated corporate debt instruments and loans and is tailored for investors who have a moderate to aggressive risk profile. The CAP iO Fund is ideal for the goal-driven investors who are targeting medium-term investment objectives, such as; higher education or home acquisition. This is the first fund in NCB Capital Markets Non-Diversified Unit Trust Scheme.

M Fund | JMD Money Market Portfolio

Invest in a fund with relatively low risk. Enjoy access to your money when you need it while still earning attractive returns.

Our NCB CAP M Fund invests in short-term fixed income government securities and commercial paper. The CAP M Fund is for the conservative investor or to meet your short-term liquidity needs. Invest in the Cap M Fund and enjoy access to your money, relatively low risk while still earning attractive returns.

E Fund | NCB Caribbean Equity Portfolio

A diversified portfolio of local and regional stocks managed with the objective of providing you with long term capital growth.

Our NCB CAP E Fund comprises carefully selected local and regional stocks managed with the view to provide you with capital appreciation and enhanced returns over the long run. Invest in the Equity Fund and diversify your portfolio while benefitting from our investment expertise. Start with a minimum of J$50,000 today.

xM Fund | USD Money Market Portfolio

Invests primarily in US dollar denominated short-term money market and other interest-bearing instruments such as reverse repurchase agreements, commercial paper, and investment grade obligations of sovereigns and companies globally.

Our xM Fund is for conservative investors with low-risk tolerance who are seeking to invest pending a longer term investment decision and whose primary concern is the security of principal.

x B Fund | USD Bond Portfolio

Invests primarily in medium to long-term fixed income securities. The investment objective is to maximize total return in US dollars and provide capital appreciation.

Our xB Fund is for investors who have a moderate to aggressive risk profile and are willing to accept moderate to high fluctuations in unit prices over the short term.

APPLY NOW for an NCB CapFund that best suits your investment needs. A Wealth Advisor is waiting to assist you.